One West Bank currently owns and operates 73 banks throughout Southern California and holds over 23 billion in assets. On July 11th, 2008 the Office of Thrift Supervision closed IndyMac Bank FSB and named the Federal Deposit Insurance Corporation (FDIC) the conservator. Less than one year later on March 19th, 2009 a shell company set up by Steve Mnuchin named IMB HoldCo LLC set up a new Federal Savings Bank called OneWest Bank, and began buying up IndyMac assets from the FDIC.

OneWest purchased over 6 billion in IndyMac customer deposit accounts and 20.7 billion in other assets at a discount of 4.7 billion. Among the 26.7 billion assets, 12.8 billion of the assets were in single-family mortgage loans. This was at the height of the housing crisis in the late 2000s, and OneWest bank now holds the fate of over 30 thousand homeowners in their hands. Even after receiving over 26 billion in assets at a discount of 4.7 billion, OneWest still preyed on those who had single-family mortgage loans. OneWest instantly profited in over 22 billion in assets and kicked innocent families out of their homes anyways.

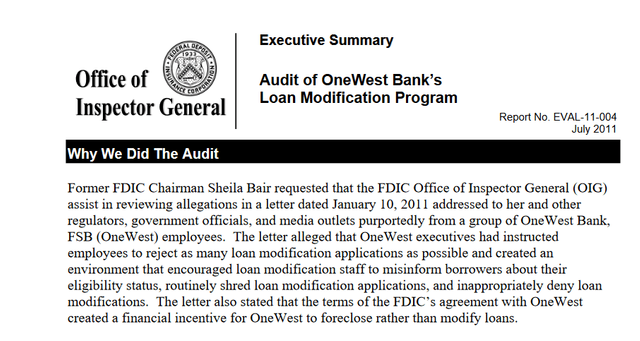

Documents prove OneWest did far worse than that. OneWest refused to re-finance mortgage loans knowing these loans were designed to force homeowners into debt and eventually would foreclose on their homes when they could no longer pay. They lied, misled, and deceived homeowners into predatory mortgage loans knowing the loanee couldn’t afford the payments. The Office of the Inspector General wrote in 2011 that:

“OneWest executives had instructed employees to reject as many loan modification applications as possible and created an environment that encouraged loan modification staff to misinform borrowers about their eligibility status, routinely shred loan modification applications, and inappropriately deny loan modifications. The letter also stated that the terms of the FDIC’s agreement with OneWest created a financial incentive for OneWest to foreclose rather than modify loans.”

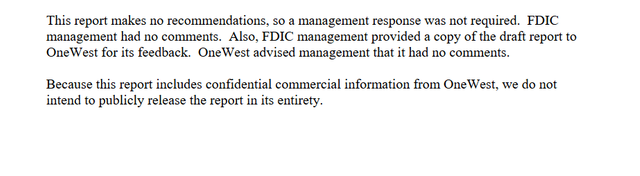

Despite stating this in the 2011 audit of OneWest Bank’s “Loan Modification Program,” the Office of the Inspector General decided not to pursue the case further. After only reviewing 260 mortgage loans from OneWest who at the time held 12.8 billion in mortgage loans the OIG concluded:

“This report makes no recommendations, so a management response was not required. FDIC management had no comments. Also, FDIC management provided a copy of the draft report to OneWest for its feedback. OneWest advised management that it had no comments. Because this report includes confidential commercial information from OneWest, we do not intend to publicly release the report in its entirety.”

This audit was done in 2011, during this time Kamala Harris was the Attorney General of California. Her former aid Lenore Anderson was busy setting up Californians for Safety and Justice which was a criminal justice reform initiative set up and funded by the Open Society Foundation as reported by the Los Angeles Times. Open Societies is owned and operated by George Soros. The Los Angeles Times wrote: “The organization operates under the umbrella of a San Francisco-based nonprofit clearinghouse, which effectively shields its donor list and financial operations from public view.”

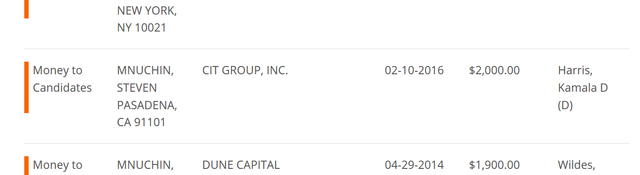

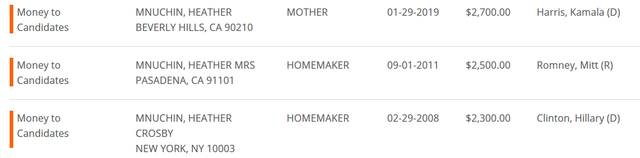

Kamala Harris’s connections to billionaire Goerge Soros go much deeper than that as reported by both counterpunch.com and The Intercept. This is not corrupt nor abnormal, but what is concerning is that George Soros helped sell OneWest Bank in 2014 for 3.4 billion to CIT Group. In 2015 Steve Mnuchin maxed out a donation of 2,000 to Kamala Harris’s Senate campaign which came from Steve Mnuchin of CIT Group.

Confused? According to public records, Steve Mnuchin was the Chairman of OneWest bank, but when he sold the bank to CIT Group he joined CIT Group’s Board. Ellen Alemany chairwomen and CEO of CIT Group gushed about Steve Mnuchin when he resigned from CIT Group’s Board after being picked by President Trump to be the Secretary of State stating: “On behalf of the entire Board, I want to thank Steven for his contributions to CIT.”

Steve Mnuchin has spent over half a billion dollars donating to Republican Committees and PACs across the United States, yet Kamala Harris seems to be the only democrat he is interested in donating his money to. When she was the DA of California Steve and his wife both donated to Kamala Harris and then again when she ran for Senate. What we have here is a clear case of quid pro quo. Let’s say that I am being charged with a crime, and I donate 2,000 dollars to the prosecutor in my case, and that prosecutor despite a plethora of evidence refuses to prosecute my case, that would be corrupt right? Well, that is exactly what Steve Mnuchin did with Kamala Harris.

Written by Joziah Thayer – Twitter @ Dapeaple – You can read more of my articles on wedacoalition.org

Kamala Harris has her off shore accounts in her daughters name. Funded by George Soros. Every elected official and now also many appointed officials has an off shore account in which you can deposite their bribe. Its easy, just tranfer funds from your off shore account.

LikeLiked by 1 person